The best way to protect your family’s assets and avoid financial fraud is to take preventative measures. From not sharing passwords/PINs to monitoring your accounts regularly, there are easy things that can have a big impact on how protected your accounts are. It is also your responsibility to protect yourself and be aware of your account activity, to help you catch any suspicious transactions immediately. 40 per cent of Canadians say they should be responsible to protect themselves against financial fraud.

When my mother was driving to Florida one year, her debit card was declined at a gas station. She called TD immediately and they informed her that it had been compromised and they were already on it. They made sure she had sufficient funds to get to her vacation destination and couriered out a new card the next day. Knowing that we’re with a bank that is proactive with fraud and supports their customers is very important to our family. TD has compiled some proactive ways to help protect you and your loved ones from financial fraud.

1. Set up Fraud Alerts – Banks are increasingly using text messaging to communicate with their customers. TD Fraud Alerts are texts that notify a customer if TD detects suspicious activity made with their TD Access Card on their personal banking accounts. The customer can reply to the alert with a simple “Y” or “N” to confirm whether they recognize the transaction and TD will unblock or block their TD Access Card accordingly based on the response. TD will never ask a customer to reply to a Fraud Alert text with any personal information or ask customers to click on any links in their reply.

1. Set up Fraud Alerts – Banks are increasingly using text messaging to communicate with their customers. TD Fraud Alerts are texts that notify a customer if TD detects suspicious activity made with their TD Access Card on their personal banking accounts. The customer can reply to the alert with a simple “Y” or “N” to confirm whether they recognize the transaction and TD will unblock or block their TD Access Card accordingly based on the response. TD will never ask a customer to reply to a Fraud Alert text with any personal information or ask customers to click on any links in their reply.

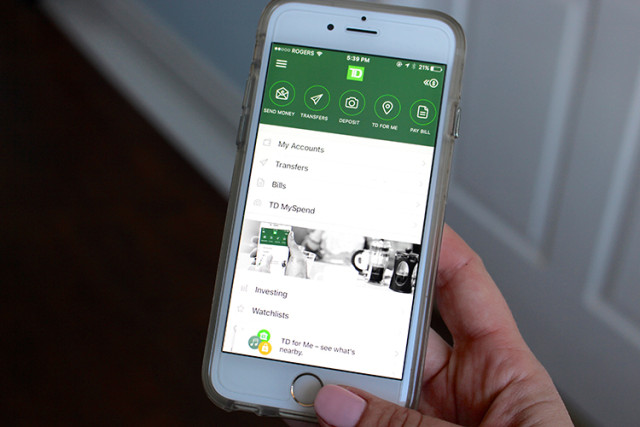

2. Monitor your bank statements and online accounts regularly – Check your statements, online accounts or banking apps regularly – This will alert you to fraudulent transactions more quickly. Money management apps, like the TD MySpend app, can be helpful tools since they help TD customers to be aware of certain types of transactions on eligible TD accounts and credit cards. The TD MySpend app provides notifications of spend transactions in real-time, which helps make it easy for customers to recognize a fraudulent purchase quickly.

2. Monitor your bank statements and online accounts regularly – Check your statements, online accounts or banking apps regularly – This will alert you to fraudulent transactions more quickly. Money management apps, like the TD MySpend app, can be helpful tools since they help TD customers to be aware of certain types of transactions on eligible TD accounts and credit cards. The TD MySpend app provides notifications of spend transactions in real-time, which helps make it easy for customers to recognize a fraudulent purchase quickly.

3. Protect your passwords and PIN –The only person who should know your PIN is you – not even your bank knows it. Don’t ever give out your PIN, whether in person, over the phone, online or by mail. You should also never leave your cheques unattended and if your chequebook is lost or stolen, call your bank immediately.

4. Avoid the lure of phishing – Financial fraud continues to evolve; it’s become more sophisticated, harder to detect, and heavily takes advantage of people’s emotions like fear and excitement. Exercise caution when receiving unsolicited e-mails containing attachments or asking you to click a link and provide sensitive information. Banks will not ask you to provide personal information, or login information such as usernames, passwords, PINs, security questions and answers, or account numbers, through unsolicited e-mail.

5. Verify if it’s real – If you receive an unexpected and too-good-to-be-true cheque, chances are it may be fraudulent. It’s always important to know who you’re doing business with.

Here are a few of my own tips as well:

5. Use a reputable bank – One of the best ways to protect yourself from fraud is to be with a reputable bank where you are always able to reach somebody and can find a branch country-wide if you run into a problem. My parents opened up my first bank account at TD when I was a little girl; my parents both got their first accounts there as well; my grandparents banked with TD and now our own little Lucy is a 4th generation TD customer. Whenever I’ve had an issue or concern, I’ve gotten help right away, which gives me piece of mind.

6. Have conversations with kids and elderly family members – Both of these groups are vulnerable to savvy scammers, as they may not be aware of potential fraud. According to a recent TD survey, 85 per cent of Canadians worry about themselves or their loved ones becoming a victim of financial fraud. When it comes to concern for their loved ones, more than one third (37 per cent) worry that their elderly family members are too trusting and that their children are unaware of the risks.

7. Protect your Paperwork – Store financial documents and unused credit cards in a secure location. Shred documents that contain personal or financial information before discarding.

8. Keep Your Cards Secure – Keeping your cards loose in your back pocket makes it easy to fall out and be potentially used by someone else. Store all important cards in a wallet or in a safe space at home. If you do notice something is missing, report lost or stolen checks and debit or credit cards immediately.

Anytime you suspect that you may be victim of financial fraud, call your bank immediately. Consumers, businesses and banks work together to help identify and avoid financial fraud. I hope this has given you some helpful reminders on how to protect you and your loved ones.

Disclaimer – This post was sponsored by TD as part of the YummyMummyClub.ca. All opinions and thoughts are my own.